Government Debt – Analyzing the Movement

Central government’s total debt is projected to increase to Rs 187 lakh crore by the end of FY25, as per the budget projections. This corresponds to an increase of 8.7%…

Budget – Understanding Deficit Terminologies

The budget proposal projects a decline in fiscal deficit (FD) from 5.8% of GDP in FY24 to 5.1% in FY25 whereas revenue deficit is projected to decline from 2.8% to…

Budget 2024-25 – Shunning the ‘Populism’

The ‘interim budget’ for the year 2024-25, presented by the finance minister Nirmala Sitaraman, did not make any populist announcement. The budget did not list out too many new proposals…

Structure of Banking Sector in India. Part III – Cooperative Banks

Cooperative banks form the third pillar of India’s banking structure. These are further classified as urban cooperative banks (UCBs) and Rural co-operative banks (RCBs). Both urban and rural cooperatives play an…

Structure of Banking Sector in India. Part II – NBFCs

NBFIs (non-banking financial institutions) form the second pillar of banking structure. They are further grouped into Non-Banking Finance Companies (NBFCs), All India Finance institutions (AIFIs) and Primary Dealers (PDs). NBFCs…

Structure of Banking Sector in India. Part I – SCBs (Scheduled Commercial Banks)

India’s banking sector is built around three pillars – Scheduled Commercial Banks (SCBs), non-banking financial institutions (NBFI) and Co-operative Banks (CBs). Each pillar is sub-divided into a large number of…

Beyond GDP – Measuring Happiness!!

Every new year brings with it hopes of a happy new year. But are we really becoming happier? The World Happiness Report for 2023 shows divergent trends in happiness score…

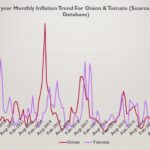

The Year That Was – 2023

Inflation management remained the focus of global policy makers while the economic performance varied across nations. While US seems to have done well, UK, EU continue to remain under stress.…

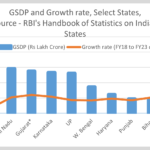

State of the Economy

India’s GDP is projected to grow by 6.7% during Q3’FY24 as per RBI’s state of the economy report published yesterday. However, its projection may be conservative as it had projected…

Analysing Banks’ Credit Growth and RBI’s Action

The recent move by RBI to increase the risk weight on certain categories of retail loan and bank loan to NBFCs is a pre-emptive measure to manage the buildup of…