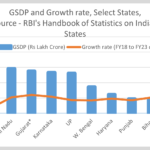

Indian States – Analyzing Economic & Social Performance

The economic performance of different states does not get the desired attention even though there is significant disparity among them. The mass exodus during the pandemic was a testimony to…

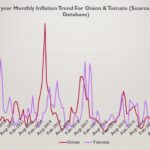

How Effective Is Monetary Policy in Controlling Inflation?

CPI (consumer price index) based inflation declined from a peak of 7.8% in April’22, when MPC started raising rates, to 4.3% by May’23. However, it kept moving erratically, rising again…

Semiconductor Industry & India’s Efforts to Get a Foothold

Indian government has been taking several measurs to help build an ecosystem for semiconductor manufacturing in the country. The $10 bn worth of production linked incentives (PLI), first announced in…

Derivatives Market in India – An Overview

Derivates market in India has caught the fancy of investors with the turnover increasing over two hundred times in last five years! While derivatives serve an important function as hedging…

Understanding NEER and REER

The rupee has depreciated by about 9% against the dollar since the Fed started raising interest rate in March’22. Over last ten years, it has depreciated by over 30%. However,…

Purchasing Power Parity (PPP) – An Overview

Purchasing Power Parity (PPP) is an important economic concept, requiring significant efforts to arrive at an authentic value. World Bank carries out an extensive exercise, called International Comparison Program (ICP),…

Annual Survey of Indian Industries – Part II

Recap – As per MOSPI survey, there are a total of 2.50 lakh factories in the country with Rs 55.4 lakh crore of capital invested at the end of FY22.…

Annual Survey of Indian Industries – Part I

The results of Annual Survey of Indian Industries for the year FY21 and FY22 shows an increase of 30% and 56% in profits during the two years. This looks contrary…

The Progress Against Global Tax Evasion

Global tax evasion remains a challenge as per a report by EU tax observatory, an EU funded research body. The good news is that these evasions have come down significantly…

Analyzing RBI’s Balance Sheet – FY24

RBI’s balance sheet for the year 2023-24 (FY24) has expanded by a substantial 11.1% as per its annual report released recently. This is significantly lower than increase of 2.4% in…