Budget, FY25. Revenue & Expenditure Analysis – Part II

Against total receipt of Rs 32.1 lakh crore, central government is projected to spend nearly Rs 48.2 lakh crore in FY25. Other than interest payments, broad areas which account for…

Budget, FY25. Revenue & Expenditure Analysis – Part I

The Budget proposal projects total expenditure of Rs 48.2 lakh crore against receipt of Rs 32.1 lakh crore for the year 2024-25 or FY25. This implies fiscal deficit of Rs 16.1…

Budget 2024-25 Highlights

The full budget for FY24-25 has been a marked departure from the interim budget with strong focus on employment generation and boosting domestic manufacturing capacity. Some of the highlights of…

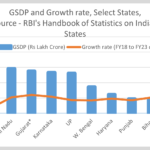

Analyzing GDP Growth – FY24

GDP (Gross Domestic Product) of Indian economy grew by 7.8% during Jan-March’24 quarter (Q4’FY24) and 8.2% in FY24, full year as per the data released by NSO (National Statistical Office).…

Global Trade – Analyzing the Performance

Global trade stood at $31.5 trillion in 2023, decline of about 2% over previous year as per the WTO (World Trade Organization) report. While the figure may look like a…

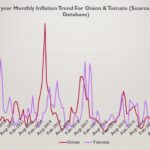

Inflation Analysis – FY24

India’s inflation based on WPI and CPI showed divergent trend for the year ended March’24 (FY24) but from different initial level. While CPI moved down to 4.85% in March’24 from…

Insurance Industry in India – An Overview

Insurance sector in India has low visibility despite sitting on a large corpus, almost one-fourth the size of the entire banking industry. The sector provides an alternate channel for financial…

Analyzing Corporate Bond Market

Corporate bond market in India has come out of the uncertainties arising due to defaults a few years ago. However, the full potential can be tapped only when sufficient incentives…

Global Food Price Inflation – Understanding the Dynamics

After sharp increase for two consecutive years, food prices have recorded a decline of 14% in 2023 as per Food & Agriculture Organization (FAO). However, prices are still about 26%…

Analyzing India’s Financial Sector Interconnectedness

Financial structure of a country is a network of institutions such as Banks, NBFCs, HFCs, Insurance companies, mutual funds and so on. All of these are connected to each other…